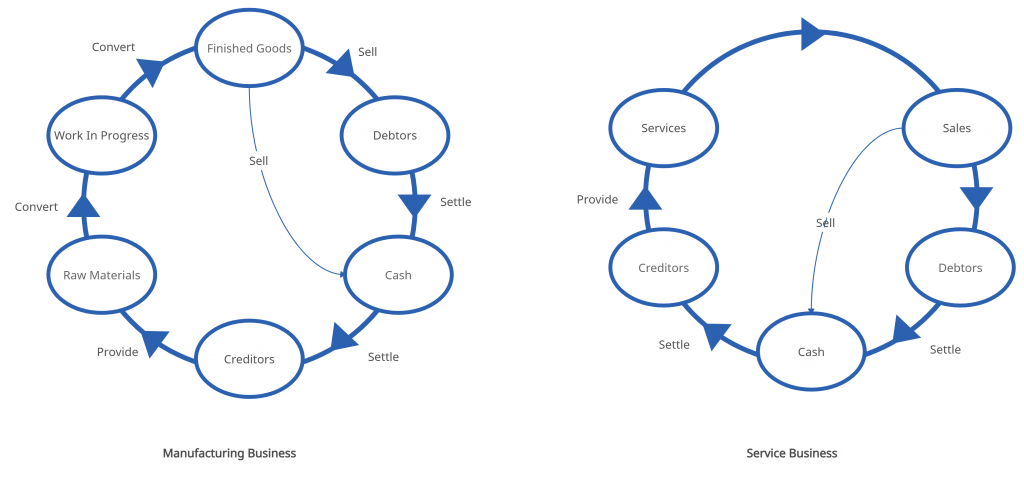

Working capital refers to the capital or cash reserves of a business that is utilized to conduct its day-to-day operations. This is calculated by deducting the current liabilities against current assets. An effective working capital management strategy will help an organisation maximise profitability and liquidity. Inventories, trade receivables and cash (in hand and at the bank) are the main components of current assets. Trade payables, bank overdrafts and short-term loans are categorized under current liabilities.

Working Capital Management

An analysis done by the globally renowned auditing firm PwC on the impact of the COVID-19 outbreak states that in times of crisis, businesses should focus on liquidity rather than profitability in the short run. Therefore, an effective working capital management strategy is vital for a company’s survival.

Thriving Vs. Surviving

Whether an organization is thriving or surviving depends on profitability and liquidity. For instance, highly profitable and liquid companies thrive, while businesses that see a dip in profits but manage to maintain a healthy level of liquidity within their operations, survive. The key here is effective management of the working capital.

In certain instances, profitable organizations often experience setbacks as a result of inadequate funding to meet short-term obligations. Especially, in the current context where the global economy has been affected due to the COVID-19 pandemic, exercising a certain degree of discipline when it comes to strategic investments is prudent.

What is a Working Capital Management Strategy?

Broadly, there are three working capital management strategies – conservative, hedging and aggressive. The effectiveness of these three approaches depends on risk and profitability.

Conservative

The conservative strategy relies on long-term financial instruments to source funds for fixed assets, permanent working capital and part of the temporary working capital. Since long-term finances are impervious to the risk of interest rate fluctuations, these prove to be low risk. As there is “no pain, no gain,” such finances also have low profitability.

Hedging

Hedging or maturity matching utilizes long term funding sources to finance long-term assets and a portion of the permanent working capital. Here, the temporary working capital will be funded by short term finances such as trade credit, short term loan. Financing of fixed assets such as machinery and infrastructure will be fulfilled through long term funding. This strategy poses moderate risk and profitability.

Aggressive

Where the aggressive strategy is concerned, long-term funds are used to finance fixed assets and part of the permanent working capital. The remaining portion of the permanent working capital and the temporary working capital will be financed through short term funding sources. This poses a high risk, but increased profitability since the finance cost of short-term funds are comparatively low, and at the same time those could be affected by market trends and interest rate fluctuations.

How to Plan an Effective Working Capital Management Strategy

Factors such as interest rates, market demand for business output, economic status, currency rate, and seasons (or market trends) greatly impact working capital management. Inter-connections between these aspects make managing working capital an intricate affair that requires a great deal of attention. For instance, the pandemic has pushed the global economy into a recession, resulting from border closures, the collapse of trade and travel bans.

Consequently, market demand, interest and currency rates too, have taken a hit as trading has come to a cease. As a result, companies are now navigating through uncharted territories to recover from this situation.

Let’s take a look at the steps that need to be followed to create a result-oriented working capital management strategy.

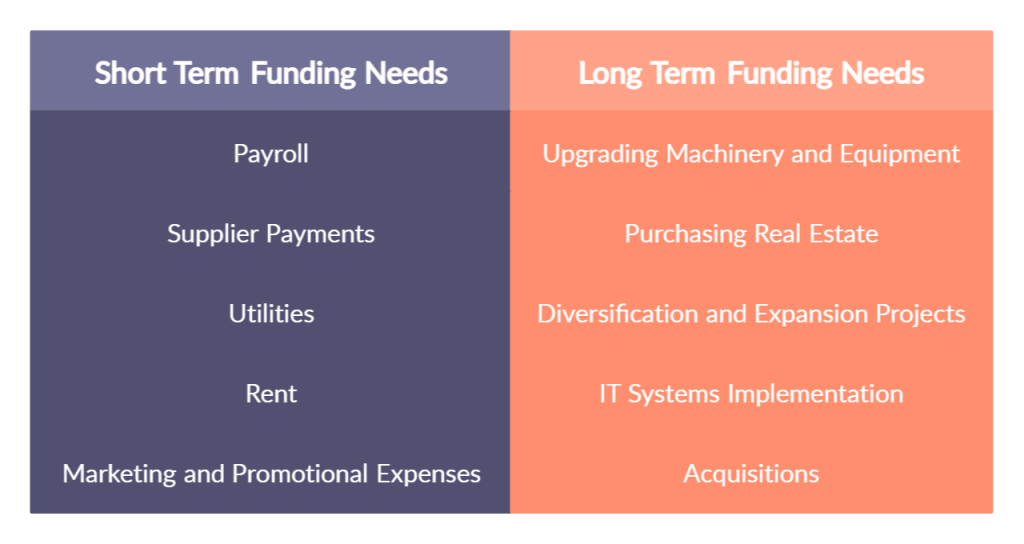

Analyze Current and Future Funding Requirements

The first step in building a successful working capital management plan is to analyze your future long and short term funding requirements. While rent, utilities, payroll, and supplier payments are classified under short term funding needs; upgrading of machinery and equipment, purchasing real estate for the company and other expansion activities require long term capital. Therefore, an analysis of your current and future funding needs is essential when preparing the organization’s working capital strategy.

Imagine Scenarios and How Your Company Might Navigate Through Those

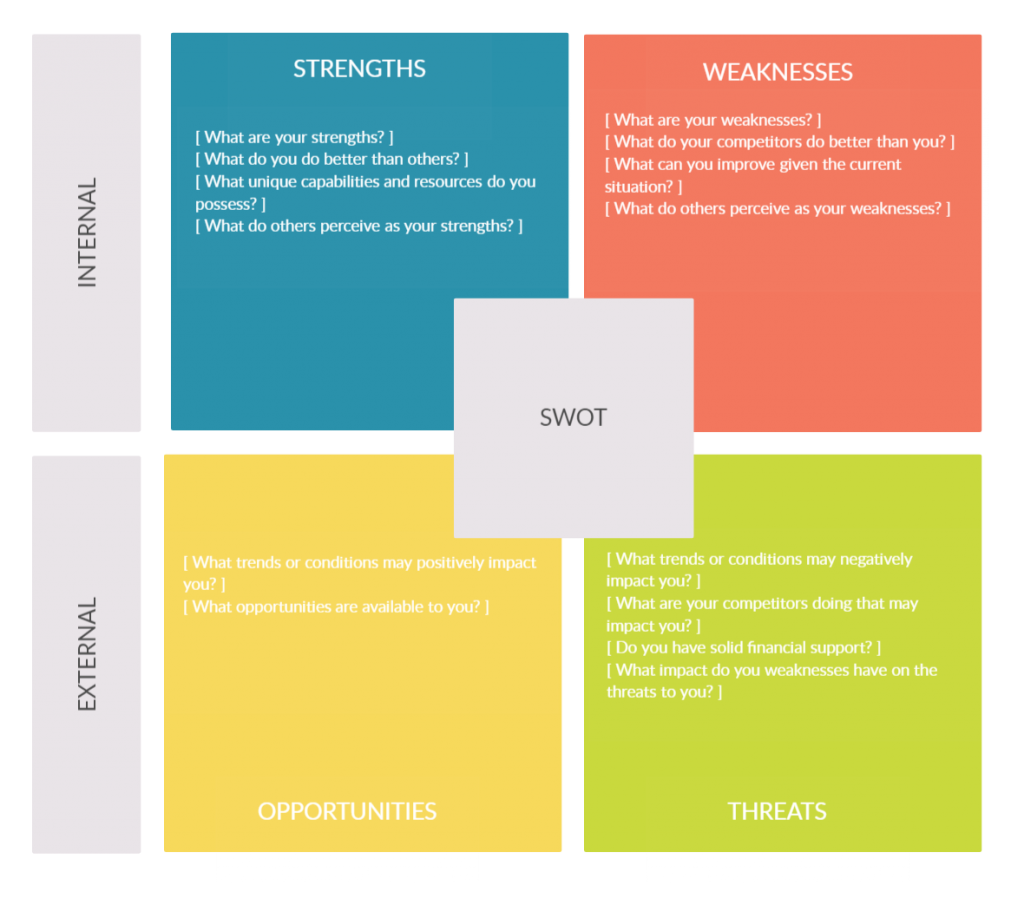

We are living in a Volatile, Uncertain, Complex and Ambiguous (VUCA) environment. Therefore, it is important to pay close attention to market trends and the status of the industry and economy. Perform a SWOT analysis to understand potential growth opportunities and threats. For instance, if the company had to halt operations due to a possible lockdown (due to pandemic or any other factor), are there sufficient funds available to meet payroll requirements and supplier payments? Or what available funding sources could power an expansion opportunity?

Once you have identified the opportunities and threats, you can conduct scenario and shock analysis to determine how well the organization would face such a circumstance.

Evaluate Your Working Capital Funding Sources

Review your current cash accounts, trade receivables and inventories to ensure that the funds at hand are adequate to meet the organization’s working capital requirements. Diversify where necessary; you may either opt for a short term loan to bridge capital shortfalls or short term investments to gain an additional income. It is also advisable to hold the company’s cash and investments in at least two different institutions to ensure access to credit in tough economic conditions.

Review Account Payables and Receivables

Go digital. Introduce online or electronic payment methods for your products or services to eliminate any delays in trade receivables. Enhancing customer convenience in terms of payment will also result in improving the demand and overall consumer satisfaction. Consider the 5Cs method before approving credit to a customer so that the chances of them being turned into bad debtors will be considerably less.

As for account payables, implement a process or schedule for cash and cheque payments to suppliers which will be subject to an approval process. This will eliminate ad hoc payments while streamlining the payment procedure.

Make Wise Strategic Management Decisions

What works best for a company obviously depends on the strategic decisions made by the organization with regards to its operations and assets. However, managing its working capital is an art that every business entity should master to survive in any industry.