A vision board is a powerful tool that helps you visualize your goals and dreams by creating a visual representation of them. When it comes to finances, a money vision board can be an effective way to focus your efforts and keep your financial goals in sight. In this guide, we’ll walk you through the steps to create a money vision board that will help you achieve your financial aspirations.

What is a Money Vision Board

A money vision board is a tool that helps you picture your financial goals and stay focused on achieving them. It’s a visual display of images, words, and other items that represent what you want to achieve with your money. By looking at your vision board regularly, you remind yourself of your goals and stay motivated to reach them.

The primary purpose of a financial vision board is to clearly visualize your financial goals and keep you motivated as you work towards them. By having a tangible representation of your ambitions, you’re more likely to stay committed and take actionable steps towards achieving them. Research shows that visualizing your goals can significantly boost your chances of success by activating the brain’s reticular activating system (RAS), which helps you notice opportunities and resources that align with your objectives.

Explore,

Key Components of a Money Vision Board

Creating a money vision board is a fun and motivating way to focus on your financial goals. Here are the key components you’ll need:

1. Financial goals

Financial goals are the foundation of your vision board. Decide what you want to achieve with your money, such as saving for a trip, buying a new car, or paying off debt. Make sure your goals are specific and measurable to track your progress effectively.

2. Images

Pictures that represent your goals make them more tangible and inspiring. Find or print images that symbolize your financial aspirations, such as a picture of a house if you’re saving for a home, or a dream vacation destination. These visuals keep you motivated and focused.

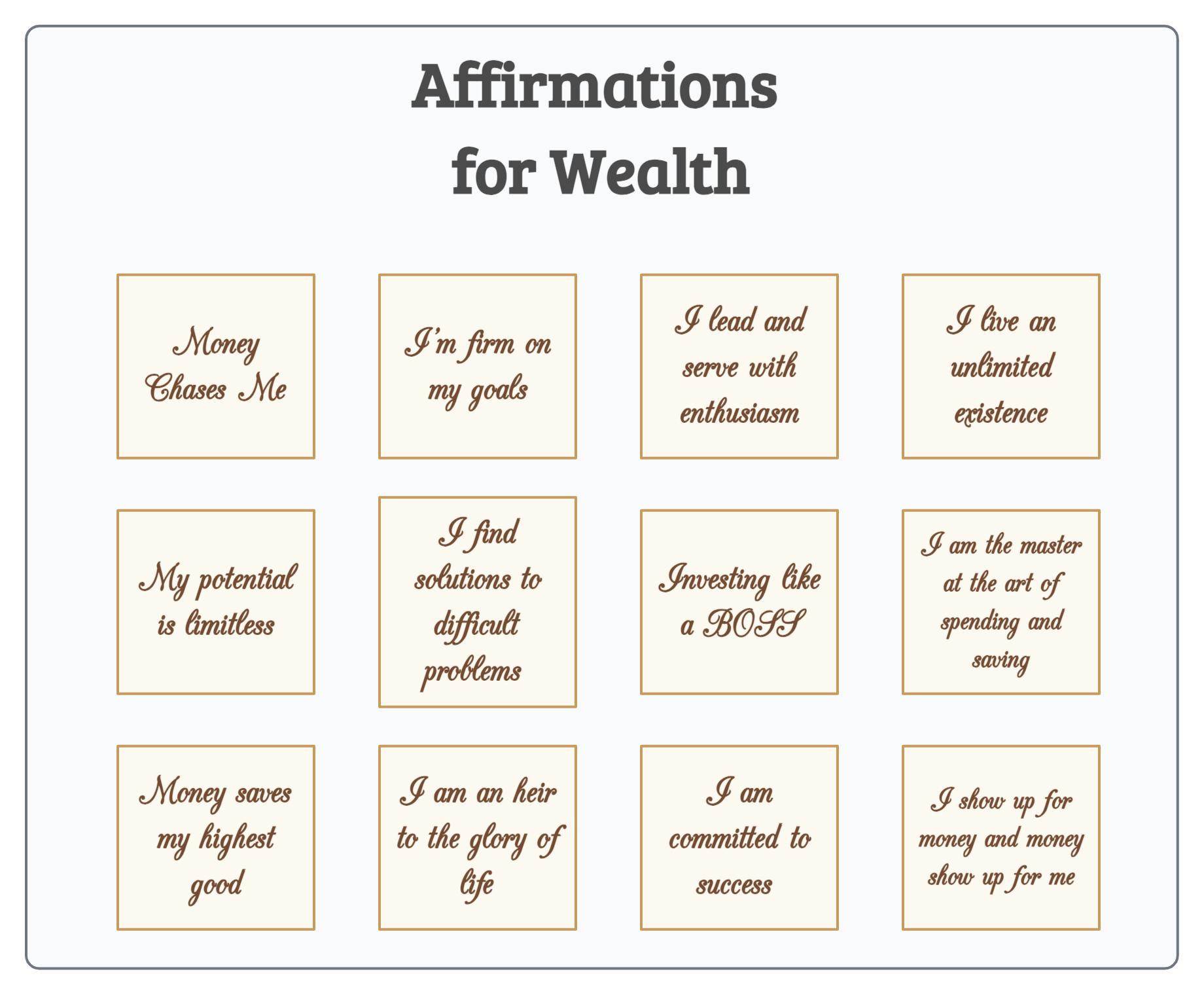

3. Quotes and affirmations

Incorporate motivational quotes and positive affirmations to keep your spirits high. Quotes that inspire you to stay focused on your goals and affirmations that reinforce your belief in your ability to achieve financial success can be powerful tools for maintaining motivation.

4. Personal touches

Add photos of loved ones and mementos that have personal significance. These personal touches remind you of who you’re working hard for and why your financial goals are important. They add emotional depth and personal connection to your vision board.

5. Timeline and deadlines

Set milestones and deadlines for your financial goals to track your progress. Breaking your goals into smaller steps with specific deadlines helps you stay on schedule and provides a clear roadmap to follow. Visual timelines can be particularly effective.

6. Action steps

Outline specific actions you need to take to achieve each goal. Writing down actionable steps, such as cutting down on eating out to save money, helps you translate your vision into practical, daily activities that move you closer to your objectives.

7. Sections or themes

Organize your board into sections or themes for different goals, like “Savings,” “Investments,” “Debt Reduction,” and “Dream Purchases.” This structured layout ensures that each area of your financial life is addressed and keeps your vision board organized and easy to navigate.

Money Vision Board Templates

Templates make creating your money vision board easier and more organized. In this section, you’ll find templates for different financial goals, whether it’s saving for a big purchase, getting out of debt, or building wealth. Use these templates to stay focused and on track.

Vision Board for Future Investment

Wealth Affirmation Vision Board

Financial Vision Board

Visionary Vison Board

My Financial Vision Board

How to Create a Money Vision Board

Follow these steps to create a money vision board that helps you visualize and achieve your financial dreams. Keep your vision board updated and let it inspire you to take the necessary actions to reach your financial goals.

Step 1: Clarify your financial goals

Think about what you want to achieve with your money. Your goals can be short-term, like saving for a vacation, medium-term, like buying a car, or long-term, like saving for retirement. Make sure your goals are specific and measurable so you can track your progress.

Step 2: Gather your materials

You’ll need some basic materials to create your vision board. These include a poster board or corkboard, magazines, newspapers, printed images, scissors, glue, markers, and decorative items. If you prefer a digital version, you can use apps like Creately, Canva, or Pinterest.

Step 3: Organize your vision board

Plan the layout of your vision board. You can create sections for different financial goals or use a timeline format to represent short-term to long-term goals. Organizing your board helps you clearly see and focus on your objectives.

Step 4: Add visual and inspirational elements

Choose images that represent your financial goals and include motivational quotes and affirmations. Adding personal touches, like photos of loved ones and mementos, can make your vision board more meaningful and inspiring.

Step 5: Assemble your vision board

Lay out your materials and arrange them on your board. Start with larger images and build around them, ensuring the layout is balanced and visually appealing. Once you’re satisfied with the arrangement, glue everything down and add decorative elements to enhance the visual appeal.

Step 6: Display and use your vision board

Place your vision board somewhere you’ll see it every day, like your bedroom or office. This keeps your goals front and center in your mind. Spend a few minutes each day visualizing your goals and reflecting on your progress to stay motivated and focused.

Step 7: Track progress and stay motivated

Set milestones and track your progress by breaking down your goals into smaller steps with specific deadlines. Celebrate your achievements and adjust your goals as needed. Use your vision board as a constant reminder of what you’re working towards to stay motivated and committed to your financial journey.

Examples of Financial Goals for Your Money Vision Board

Including clear and specific financial goals on your money vision board helps you stay focused and motivated. Here are some examples to inspire you:

- Save for a vacation: Plan a dream trip and set a specific savings target. For example, “Save $3,000 for a trip to Hawaii by next summer.” Add pictures of the destination and activities you want to enjoy.

Buy a home: Set a goal to save for a down payment on a house. For instance, “Save $20,000 for a down payment in three years.” Include images of your ideal home and neighborhood.

Pay off debt: Focus on reducing or eliminating debt, such as credit card balances or student loans. An example could be, “Pay off $5,000 in credit card debt within 18 months.” Use visuals like a debt thermometer to track your progress.

Build an emergency fund: Aim to save a specific amount for unexpected expenses. For example, “Save $5,000 for an emergency fund within a year.” Add images that symbolize security and peace of mind.

Save for retirement: Plan for your future by setting a retirement savings goal. For instance, “Save $50,000 in my retirement account over the next five years.” Use pictures of a comfortable retirement lifestyle to motivate you.

Buy a car: Save for a new or used car with a clear savings target. For example, “Save $10,000 for a car within two years.” Include images of the car model you want.

Start a business: Set a goal to save for starting your own business. For instance, “Save $15,000 for startup costs within three years.” Use images and quotes that inspire entrepreneurship.

Invest in education: Plan to further your education or skills with a savings goal. For example, “Save $8,000 for a coding bootcamp in the next two years.” Add visuals of books, certificates, and the career you aim to pursue.

Plan a major purchase: Save for a significant item like new furniture, appliances, or electronics. For instance, “Save $2,500 for a new living room set within a year.” Include pictures of the items you want to buy.

Donate to charity: Set a goal to give back to your community. For example, “Donate $1,000 to my favorite charity by year-end.” Add images and stories of the causes you care about.

Benefits of a Money Vision Board

Creating a money vision board can provide numerous advantages in helping you achieve your financial goals. Here are some of the key benefits:

- Clarifies financial goals: A money vision board helps you clearly define what you want to achieve with your money. By visualizing your goals, you can focus on specific targets and develop a clearer roadmap for reaching them.

- Increases motivation: Seeing your financial goals represented visually can be a powerful motivator. A financial vision board keeps your aspirations front and center, reminding you daily of why you’re working towards these goals and helping you stay committed.

- Enhances focus: With a vision board, you have a constant reminder of your financial objectives. This helps you stay focused and avoid distractions that might lead you away from your path. It’s easier to make decisions that align with your goals when you see them every day.

- Boosts positivity: Including positive images and affirmations on your vision board can enhance your mindset. It encourages a positive attitude towards your financial goals, making it easier to believe in your ability to achieve them and maintain a positive outlook.

- Tracks progress: A vision board allows you to visualize your progress. As you reach milestones, you can update your board to reflect your achievements. This not only keeps you on track but also gives you a sense of accomplishment and motivates you to keep going.

- Encourages creativity: Creating a vision board is a creative process that allows you to think outside the box. It encourages you to explore different ways to achieve your financial goals and visualize your future in a more dynamic and imaginative way.

- Provides daily inspiration: Having a vision board in a place where you can see it daily provides constant inspiration. It serves as a daily reminder of what you’re working towards and can lift your spirits when you’re feeling discouraged.

- Strengthens commitment: When you see your financial goals every day, you’re more likely to stay committed to achieving them. A vision board reinforces your dedication and helps you stay accountable to yourself.

Tips to Create an Effective Financial Vision Board

Follow these tips to create an effective financial vision board that helps you stay focused, motivated, and inspired to reach your financial goals.

Be clear about your goals

Identify specific and measurable financial goals. Whether it’s saving for a house, paying off debt, or building an emergency fund, clarity is key. Make sure you know exactly what you want to achieve.

Choose meaningful images

Select images that resonate with your financial goals. These could be pictures of a dream home, a vacation destination, or a savings target. Meaningful visuals help keep you motivated and focused.

Include motivational quotes and affirmations

Add quotes and affirmations that inspire and encourage you. Positive statements like “I am capable of achieving my financial goals” can boost your confidence and keep you on track.

Personalize your board

Incorporate personal touches, such as photos of loved ones or mementos that hold special significance. Personalization makes your vision board more meaningful and connected to your life.

Organize your board

Arrange your board in a way that makes sense to you. You might create sections for different goals or use a timeline format to represent short-term and long-term objectives. Organization helps you clearly see and focus on your goals.

Update regularly

As you make progress or your goals evolve, update your vision board. Removing achieved goals and adding new ones keeps your board current and relevant.

Place it where you can see it

Display your vision board in a spot where you’ll see it every day, such as your bedroom or office. Regular visibility keeps your goals front and center in your mind.

Celebrate your progress

Acknowledge and celebrate small milestones along the way. Recognizing your achievements, no matter how minor, keeps you motivated and reinforces positive behavior.

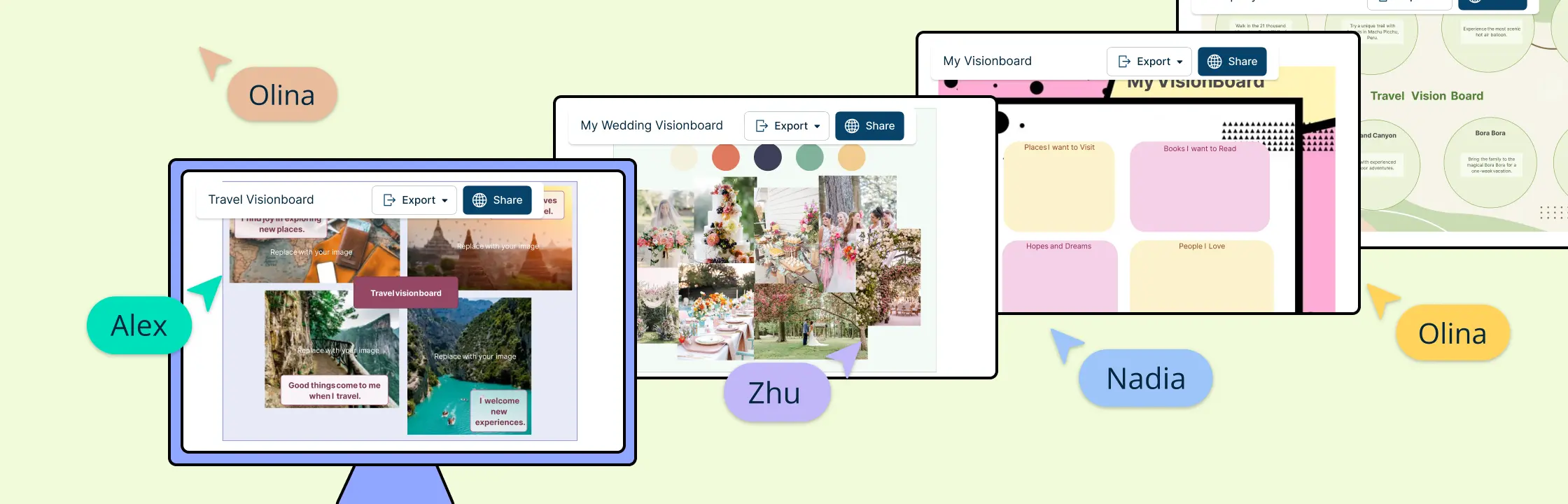

Using Creately to Create Your Money Vision Board

Creating a money vision board using a visual collaboration tool like Creately can make the process more efficient and engaging.

Easy-to-use templates

Creately offers a variety of pre-designed templates for vision boards. Choose a template that fits your financial goals and customize it to suit your needs. This saves time and provides a structured starting point.

Drag-and-drop functionality

With Creately’s drag-and-drop feature, you can easily add images, text, and shapes to your vision board. Simply drag elements from the sidebar and drop them onto your canvas. This makes it simple to organize and arrange your board.

Collaboration features

Creately allows you to collaborate with others in real-time. Share your vision board with family members, friends, or financial advisors to get their input and support. Collaborative features include commenting and editing, which can help refine your goals.

Image and media integration

You can easily import images and media files into Creately from your computer or the web. Use pictures that represent your financial goals, such as a dream home, car, or vacation destination, to make your vision board visually appealing.

Customizable shapes and icons

Creately offers a wide range of shapes and icons that you can customize to fit your vision board. Use these to represent different financial goals, milestones, or categories. Customizable elements help make your board unique and personal.

Text editing tools

Add motivational quotes and affirmations using Creately’s text editing tools. You can change fonts, colors, and sizes to highlight important messages and keep yourself inspired.

Layers and grouping

Organize your vision board by using layers and grouping features. Group related items together and use layers to manage complex layouts. This helps keep your board neat and easy to navigate.

Sharing and exporting

Share your vision board easily with others via a link or export it as an image or PDF. This makes it simple to print your board or share it on social media for additional motivation and accountability.

Progress tracking

Use Creately to track your progress by updating your vision board as you achieve your financial goals. Use built in project tracking tools including Kanban boards, per item data fields to add due dates, adjust timelines, and mark milestones to visualize your journey.

Wrapping up

Creating a financial vision board is a powerful and effective way to achieve your financial goals. By visualizing what you want to accomplish, you can stay motivated and focused on your objectives. Whether you’re saving for a vacation, buying a home, paying off debt, or planning for retirement, a vision board can help clarify your goals and keep you on track.

Gather meaningful images, quotes, and personal touches that resonate with your aspirations. Organize your board in a way that makes sense to you and place it somewhere you’ll see it daily. Regularly updating and reflecting on your vision board can reinforce your commitment and help you celebrate your progress.

By following these steps and tips, you can create a money vision board that serves as a constant source of inspiration and guidance. Stay dedicated to your financial journey, and watch as your dreams gradually turn into reality.

Explore more vision board types