Do you want to take control of your expenses and achieve your financial goals? If yes, then you need a monthly budget template. In this blog post, we will explain what a monthly budget template is, what are its components, how to use it effectively, and what are its benefits. We will also share some tips and tricks to make your budgeting easier.

What Is a Monthly Budget Template and What Are Its Uses?

A monthly budget template is a document that shows your income and expenses for a month. It can help you save more, pay off debt, invest wisely, and manage your finances. The document can be in the form of a spreadsheet, a worksheet, an app, or a software. You can use a monthly budget template to:

Set realistic and achievable financial goals

Allocate your money to different categories such as needs, wants, savings, and debt

Track your spending habits and identify areas where you can cut costs

Monitor your progress and adjust your budget as needed

Stay motivated and accountable for your financial decisions

A monthly budget template can help you manage your finances better and improve your financial well-being.

Different Monthly Budget Templates

Simple Monthly Budget

Monthly Budget Planner

Monthly Budget Plan

Components of a Monthly Budget Template

A monthly budget template typically consists of four main components:

Income: This is the money that you earn or receive from various sources such as salary, wages, bonuses, tips, interest, dividends, etc.

Expenses: This is the money that you spend on various things such as rent, mortgage, utilities, groceries, transportation, entertainment, etc.

Savings: This is the money that you set aside for future goals such as retirement, education, emergency fund, vacation, etc.

Debt: This is the money that you owe to others such as credit cards, loans, mortgages, etc.

How to Use a Monthly Budget Template

To use a monthly budget template effectively, you need to follow these steps:

Gather your financial information: Collect all your income and expense statements for the past month or use an app or software that can automatically track your transactions.

Choose a monthly budget template: Find a monthly budget template that suits your needs and preferences. You can use a pre-made template or create your own using a spreadsheet or a worksheet.

Fill in your income and expenses: Enter your income and expenses for the month in the appropriate categories. Make sure to include all sources of income and all types of expenses.

Calculate your net income: Subtract your total expenses from your total income to get your net income. This is the amount of money that you have left after paying all your bills.

Adjust your budget: Compare your net income with your savings and debt goals. If your net income is positive, you can allocate some of it to your savings or debt repayment. If your net income is negative, you need to reduce your expenses or increase your income.

Review and update your budget: Check your budget regularly and make changes as needed. Track your spending and compare it with your budgeted amounts. Celebrate your achievements and learn from your mistakes.

Limitations of a Monthly Budget Template

A monthly budget template is a useful tool but it also has some limitations. Some of the limitations are:

It may not account for irregular or unexpected income and expenses such as bonuses, gifts, medical bills, car repairs, etc.

It may not reflect seasonal or cyclical variations in income and expenses such as holidays, tax season, summer vacations, etc.

It may not capture long-term financial goals such as buying a house, starting a business, etc.

It may not suit everyone’s lifestyle or personality. Some people may find it too restrictive or tedious to follow a monthly budget template.

Advantages of Using a Monthly Budget Template

Despite its limitations, using a monthly budget template has many advantages. Monthly budget templates help you:

Create a realistic and personalized financial plan that matches your income and expenses

Prioritize your needs over your wants and avoid overspending or impulse buying

Save more money for short-term and long-term goals

Pay off debt faster and reduce interest charges

Improve your credit score and financial reputation

Reduce stress and anxiety related to money matters

Increase your financial literacy and confidence

Tips to Track Your Finances with a Monthly Budget Template

Using a monthly budget template can be challenging at first but it can also be rewarding and fun. Here are some tips to help you track your finances with a monthly budget template:

Be honest and accurate: Don’t lie or cheat on your budget. Record every income and expense accurately and honestly. Don’t forget to include cash transactions or small purchases.

Be flexible and adaptable: Don’t be too rigid or strict with your budget. Allow some room for adjustments and contingencies. Be prepared to deal with changes and emergencies.

Be consistent and disciplined: Don’t give up or quit on your budget. Stick to it and follow it every month. Make it a habit and a routine.

Be realistic and optimistic: Don’t set unrealistic or unattainable goals. Set goals that are SMART (Specific, Measurable, Achievable, Relevant, and Time-bound). Don’t be discouraged by setbacks or failures. Learn from them and move on.

Be creative and resourceful: Don’t be bored or frustrated by your budget. Make it fun and interesting. Use apps, software, tools, games, charts, graphs, etc. to make your budgeting easier and more enjoyable.

Be supportive and accountable: Don’t be isolated or secretive about your budget. Share it with your family, friends, partner, or mentor. Seek their feedback, advice, support, and encouragement. Hold yourself accountable for your actions and results.

How to Use Creately to Plan Your Monthly Budget

Creately is a powerful tool that can help you plan your monthly budget in a visual and collaborative way. Here are five steps to use Creately for your budgeting needs:

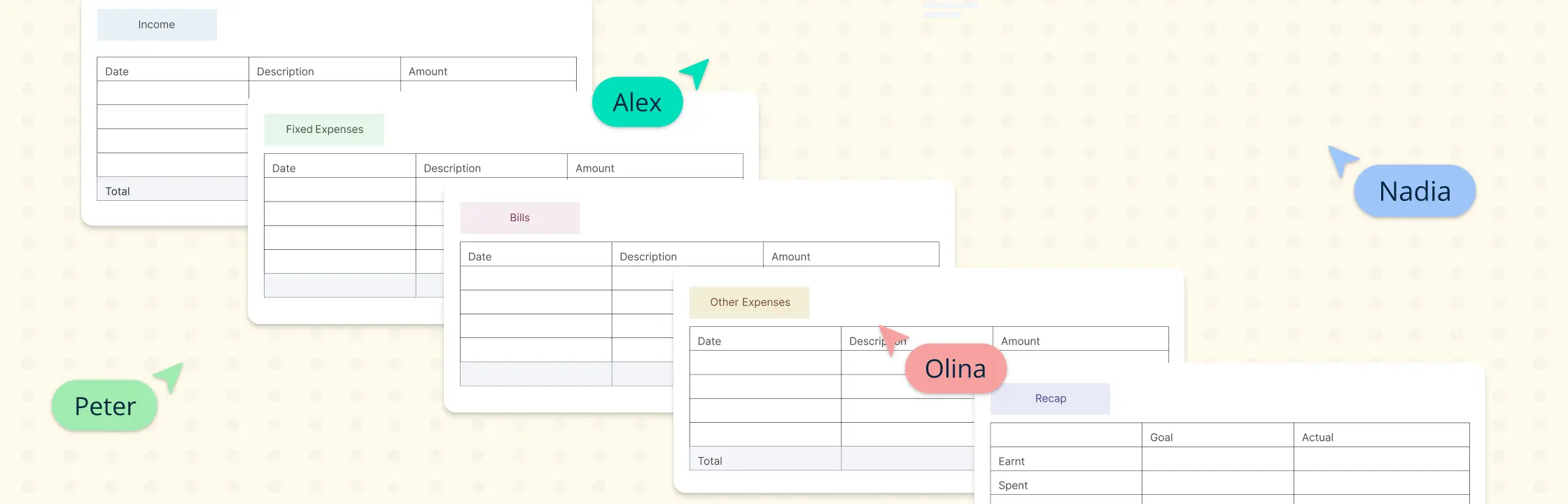

Start by creating a new document in Creately and choosing a template that suits your preferences. You can use monthly budget template or start from scratch with a simple table, a pie chart, a flowchart, or any other diagram type that you like.

Next, enter your income and expenses data into the template. You can use the drag-and-drop feature to add or remove items, or the edit menu to change the colors, fonts, and styles of your diagram.

You can also add conditional formatting to highlight any areas of concern or opportunity in your budget.

After that, use the comments and feedback feature to share your budget with your family, friends, or financial advisor. You can invite them to view or edit your document, and discuss your budget plan in real time.

Finally, use the export and publish feature to save your budget as an image or PDF file.

Wrapping Up

A monthly budget template is a powerful tool that can help you manage your finances better and achieve your financial goals faster. It can help you plan and track your income and expenses for a month. It can help you save more, spend less, pay off debt, invest wisely, and live within your means.

If you want to start using a monthly budget template today, you can download our free monthly budget template here. It is easy to use and customize. It has all the components and features that you need to create a successful monthly budget.

We hope you found this blog post helpful and informative. If you have any questions or comments about monthly budget templates, please feel free to leave them below. We would love to hear from you.

FAQs About Monthly Budget Templates

How can I reduce my expenses?

There are many ways to reduce your expenses such as:

Comparing prices and shopping around for the best deals.

Using coupons, discounts, cashback, rewards, etc.

Negotiating or switching providers for services such as cable, internet, phone, insurance, etc.

Canceling or downgrading subscriptions or memberships that you don’t use or need.

Cooking at home instead of eating out.

Making a grocery list and sticking to it.

Buying in bulk or in season.

Using public transportation or carpooling instead of driving.

Selling or donating items that you don’t use or need.

Doing DIY projects or repairs instead of hiring professionals.

How can I increase my income?

There are many ways to increase your income such as:

Starting a side hustle or a freelance gig.

Selling your skills or services online.

Creating a passive income stream such as blogging, podcasting, YouTube, etc.

Investing in stocks, bonds, mutual funds, etc.

Renting out a room or a property.

Teaching or tutoring online or offline.