An Entity-Relationship (ER) diagram for a banking system helps to visualize the relationships between various entities such as customers, accounts, transactions, and employees. Creating an ER diagram for a banking system is crucial for understanding how data is structured and how different entities interact. Below are six scenarios where ER diagrams can be used effectively in a banking system.

What Is an ER Diagram for a Banking System?

An Entity-Relationship Diagram for banking system is a visual representation of the system’s data entities, their attributes, and the relationships between them. It helps model how core components like customers, accounts, loans, transactions, employees, and ATMs are interconnected in a banking environment. The ER diagram for banking management system provides a clear map of how the system operates, showing data flow, dependencies, and interactions that ensure the smooth functioning of various banking processes.

6 ER Diagram Templates for Banking System

Explore six ER diagram templates for a banking system, each designed to represent different aspects like customer management, accounts, transactions, and loans. These templates offer a solid starting point for designing or understanding banking database structures.

1. ER Diagram for Customer Accounts Management

In this ER diagram for banking system, the ER diagram focuses on the management of customer accounts. Key entities include Customer, Account, and Branch. The relationships between these entities help track which customer holds which account and at which branch.

Example:

- Entities: Customer, Account, Branch

- Relationships:

- A Customer can have one or more Accounts.

- An Account belongs to one Branch.

This ER diagram for banking system helps banking professionals ensure that customer data is accurately linked with their account details and the branch they belong to.

2. ER Diagram for Loan Management

The Loan Management scenario involves entities such as Customers, Loans, Loan Officers, and Bank Branches. The diagram helps define how loans are granted to customers and which loan officers are responsible for managing them.

Example:

- Entities: Customer, Loan, Loan Officer, Bank Branch

- Relationships:

- A Customer can have multiple Loans.

- Each Loan is managed by one Loan Officer.

- A Loan is associated with one Bank Branch.

This This ER diagram for banking management system ensures proper tracking of loan data, payments, and the relationships between customers and loan officers.

3. ER Diagram for Banking Transactions

This ER diagram for banking system is concerned with the Transaction entity and how it connects with Account, Customer, and Bank Branch entities. The diagram helps in understanding how money is transferred between accounts and the role of different parties in a transaction.

Example:

- Entities: Transaction, Customer, Account, Bank Branch

- Relationships:

- A Transaction is initiated by a Customer.

- A Transaction affects one or more Accounts (source and destination).

- A Transaction takes place at a specific Bank Branch.

This ER diagram will allow banks to monitor, audit, and track the flow of transactions in the system effectively.

4. ER Diagram for Employee Management in a Bank

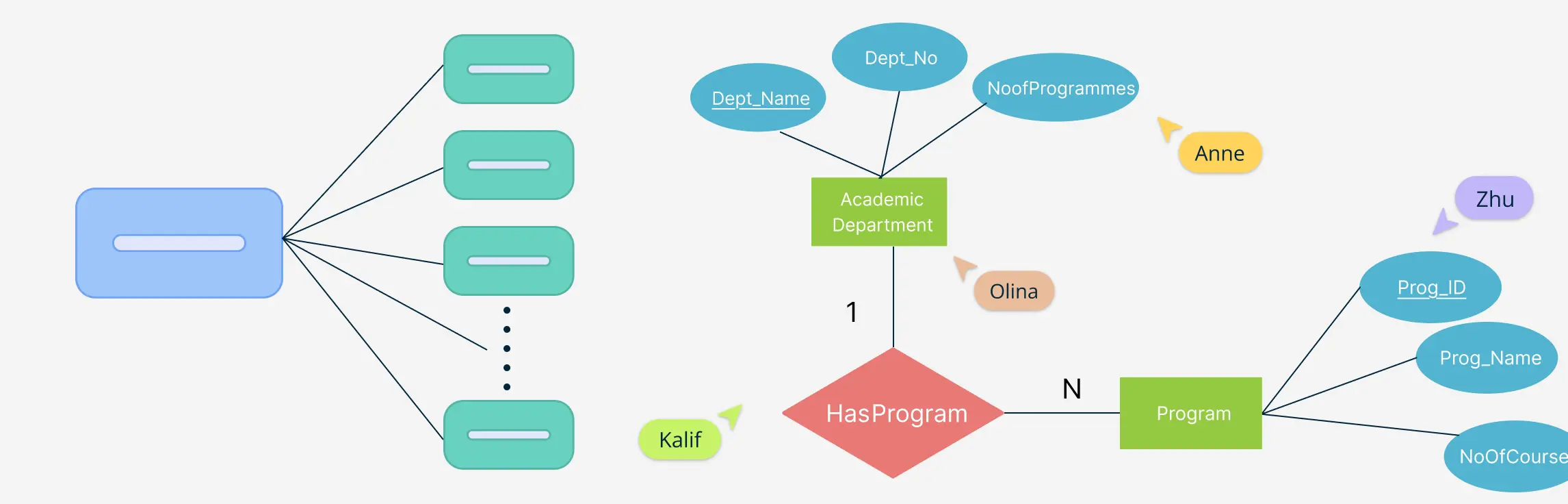

This scenario focuses on the bank’s internal operations, including the Employee, Department, and Role entities. It defines which employees belong to which department and what role they perform.

Example:

- Entities: Employee, Department, Role

- Relationships:

- An Employee works in one or more Departments.

- An Employee has one Role (e.g., Teller, Manager, Loan Officer).

This ER diagram for banking system helps manage employee data and can be useful for payroll, staffing, and reporting purposes.

5. ER Diagram for ATM System

In the ATM system scenario, the ER diagram connects Customer, ATM, Account, and Transaction entities. This diagram helps track customer withdrawals, deposits, and the specific ATM used for transactions.

Example:

- Entities: Customer, ATM, Account, Transaction

- Relationships:

- A Customer performs Transactions at an ATM.

- Transactions are linked to the Account from which funds are withdrawn or deposited.

This ER diagram for banking system ensures proper handling and tracking of ATM interactions and prevents fraudulent activities.

6. ER Diagram for Banking System Security

This scenario focuses on the Security of banking operations, involving entities such as Customers, Login Credentials, Accounts, and Transaction Logs. The diagram tracks the security measures implemented to safeguard customer data and prevent unauthorized access.

Example:

- Entities: Customer, Login Credentials, Account, Transaction Log

- Relationships:

- A Customer has specific Login Credentials to access their Account.

- Transaction Logs are generated for every transaction and linked to a Customer and their Account.

This ER diagram for banking system security is essential for identifying access patterns and improving security measures.

Importance of Using ER Diagram for Banking System

For banking professionals, system architects, database developers, and managers, understanding the ER diagram for a banking system is crucial. It ensures that data is structured efficiently and that all relationships between entities are well-defined. Here’s why it matters:

1. Efficient Data Management

An ER diagram for banking management system helps manage vast amounts of data by defining relationships and minimizing redundancy. This is critical in a banking system where accurate data handling is essential for security, regulatory compliance, and customer satisfaction.

2. Database Design and Optimization

For database administrators and system developers, an ER diagram for banking system serves as a blueprint for creating an efficient database structure. Proper design ensures that queries run efficiently, which is crucial for real-time banking transactions and system responsiveness.

3. Enhanced Security

By defining entities such as login credentials and security logs, ER diagrams help ensure that the banking system is designed to manage access control and audit trails effectively. This is critical for preventing fraud and unauthorized access.

4. Streamlined Operations

Bank managers and executives can use ER diagrams to understand how different parts of the system are connected and how the operational flow is structured. This helps in improving workflow and decision-making.

5. Clear Communication

For teams working on system development, an ER diagram serves as a communication tool. It enables non-technical stakeholders like bank executives to understand how data flows within the system, aiding in better strategic decision-making.

How Creately Helps in Creating an ER Diagram for a Banking System

Creately’s free ER diagram maker makes it easier for teams to create and maintain ER diagrams for a banking system. Here’s how you can do it in 6 simple steps:

Step 1. Start with Pre-made Templates: Creately provides a variety of banking-specific ER diagram templates that can be customized according to your needs. This saves time and offers a strong starting point, whether you are working on customer account management or loan processing.

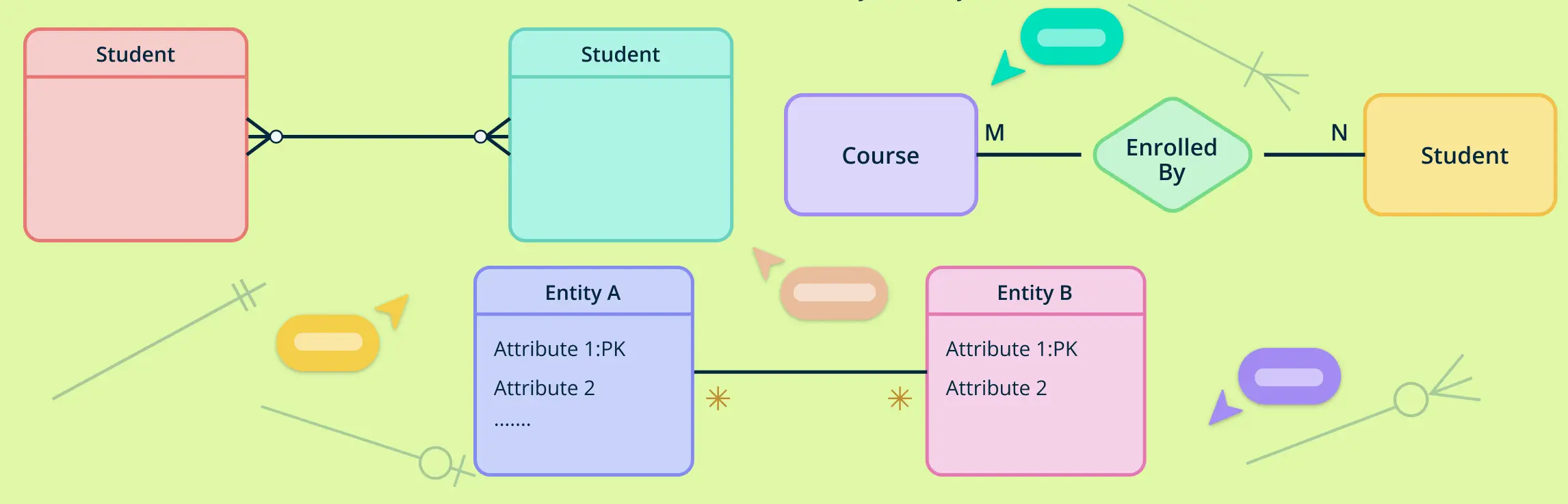

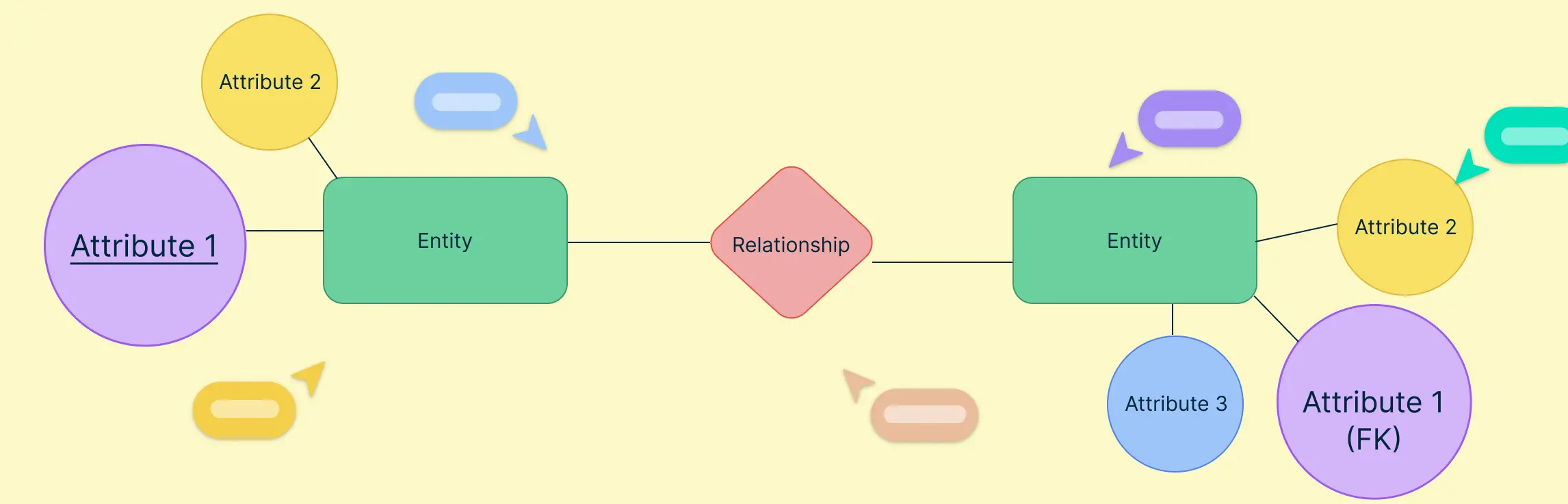

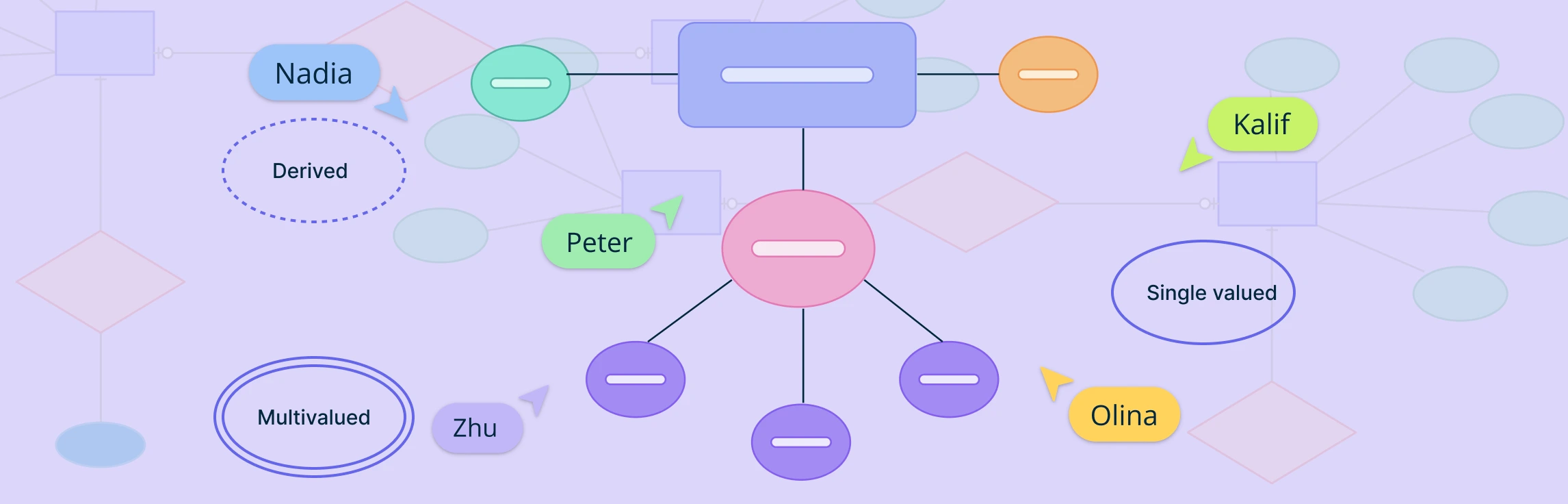

Step 2. Add and Customize Entities: Creately supports multiple formats and notations, including Chen’s, Crow’s Foot, and database tables. You can easily drag and drop elements onto the canvas and use Plus Create to create relationships between entities. The sticky notes feature allows you to add annotations or descriptions to clarify the function of each entity.

Step 3. Define Relationships Between Entities: With Creately’s intuitive interface, you can connect entities using lines and connectors to define the relationships, such as “Customer has Account” or “Account performs Transaction.” The connector types help distinguish different types of relationships (one-to-many, many-to-many), making the diagram clear and precise.

Step 4. Integrate Data for Real-Time Collaboration: Creately’s integration features allow you to sync with other platforms like Google Drive, Microsoft Teams, and Confluence. This means that data related to the ER diagram can be updated in real-time across all systems, ensuring that the latest information is available to all stakeholders.

Step 5. Use Presentation Mode: Creately’s Presentation Mode allows you to showcase your ER diagram in a professional manner during meetings or presentations. This is especially helpful for sharing the banking system design with team members, executives, or clients, ensuring clarity in communication.

Step 6. Collaborate and Iterate: With Creately’s real-time collaboration, multiple team members, from developers to system architects, can work on the diagram simultaneously. You can also add comments, feedback, and version history, making it easier to iterate and improve the design over time.

By using Creately’s powerful features, creating an ER diagram for a banking system becomes a collaborative, efficient, and streamlined process that ensures all stakeholders are on the same page and the system is designed for optimal performance.

Conclusion

An ER diagram for banking system is a crucial tool for visualizing the relationships between various entities, ensuring efficient data management, security, and operational effectiveness. By defining key entities such as Customers, Accounts, Transactions, and Loans, an ER diagram helps streamline banking processes, improve database design, and enhance communication among stakeholders. With Creately, creating and maintaining ER diagrams becomes seamless, fostering real-time collaboration and system optimization. Ultimately, a well-structured ER diagram contributes to a more secure, efficient, and user-friendly banking experience.

References

Frantiska, J. (2017). Entity-Relationship Diagrams. Visualization Tools for Learning Environment Development, pp.21–30. doi:https://doi.org/10.1007/978-3-319-67440-7_4.

ResearchGate. (n.d.). (PDF) A Comparative Analysis of Entity-Relationship Diagrams. [online] Available at: https://www.researchgate.net/publication/243781001_A.

Common entities include:FAQs on ER Diagram for Banking System

Why is an ER diagram important in a banking system?

What are the key entities in a banking ER diagram?

How are relationships represented in a banking ER diagram?

Can this ER diagram be used for both online and traditional banks?

Are these ER diagram templates for a banking system customizable?